CHF WEEKLY ROUND-UP: November 18-22, 2024

- John A

- Nov 22, 2024

- 10 min read

World markets continue to react to every bit of news coming out of the United States, but most are reacting to the upside despite elevated Geopolitical Risks in Ukraine. Hedge Fund traders seem to be betting that President-elect Donald Trump’s policy agenda is about to jumpstart volatility.

The Bank of Canada (BoC) is expected to announce another interest rate cut on December 11th, despite a rise in inflation in October to 2.0% from 1.6% the month before. BoC may not move to the widely expected 0.50% but needs to continue cutting to stimulate the Canadian economy. The TSX index was up throughout the week, opening today at another all-time high. The TSX is still favoured to outperform into 2025, so stay invested in Canada.

The U.S. dollar has been up by 4.2% since election day, and the Euro has been down to a two-year low while the CAD dollar appears to be holding its own. The Federal Reserve Chair stated that he's in no rush to move U.S. rates lower given the "remarkably good" performance of the economy. Even so, he is expected to cut by 0.25% and then wait and see what next year brings. NYSE, S&P 500, and Nasdaq were all up this week and opened higher today. Analysts are forecasting a 10%-12% rise in U.S. markets in 2025.

After a selloff, losing nearly 5%, the gold market has come back from the correction, trading near $2,700/oz this morning. Some analysts suggest that the gold market remains in a solid uptrend. Silver has pushed back above $31.00/oz today.

The Venture-listed juniors have enormous upside potential, but sentiment for juniors remains very subdued. We continue to look for the right signs that indicate the gold rally is going to broaden out. Keep an eye on trading opportunities in the Mining and Metals sector. Why not review Athena Gold Corporation (CSE: ATHA) (OTCQB: AHNR), our newest client, and its News Release below?

Base metals prices continued to be weak this week, with prices being driven down by the massive USD strength and continuing lower European and Chinese manufacturing demand. Copper is still near its two-month low at USD$4.10/lb. Nickel is just off the low for the year at USD$7.12/lb. Critical and battery minerals are also struggling. Lithium jumped to USD$10.97/kg, while Cobalt held an eight-year low of USD$11.02. Keep an eye on trading opportunities in the Mining and Metals sector as Europe and China struggle to return to growth.

It has been a highly productive week for our clients, and we are pleased to present our round-up of their news released between November 18-22, 2024.

Mining

On November 18, 2024, Athena Gold Corporation (CSE: ATHA) (OTCQB: AHNR) reported high-grade gold samples from its reconnaissance surface sampling program at its newly acquired Laird Lake project, located in Ontario's prolific Red Lake Gold District. The Laird Lake project, spanning 4,158 hectares and covering >10 km of Balmer-Confederation Assemblage contact, represents an underexplored portion of the Red Lake Gold District. The project is road-accessible and lies approximately 10 km west of West Red Lake Gold Mines' flagship Madsen mine and 34 km northwest of Kinross Gold's Great Bear project.

"We are extremely pleased that our recent expansion into Ontario is already starting to bear fruit. To our knowledge, sample F733057, returning 56.5 g/t Au, is in line with some of the highest-grade surface grab samples publicly reported in the Red Lake Gold District,” stated John Power, President & CEO of Athena Gold.

Highlights:

An initial six surface grab samples taken at the Laird Lake project in July 2024 confirmed mineralization over 2.2 km of strike length along the contact between the Balmer and Confederation Assemblages (Figure 1). Mineralization is open along strike to the east and west.

The Balmer-Confederation contact is believed to serve as a major structural control for gold mineralization in the Red Lake Gold District, with >90% of all gold ever mined in the camp occurring within approximately 300 m of this contact.

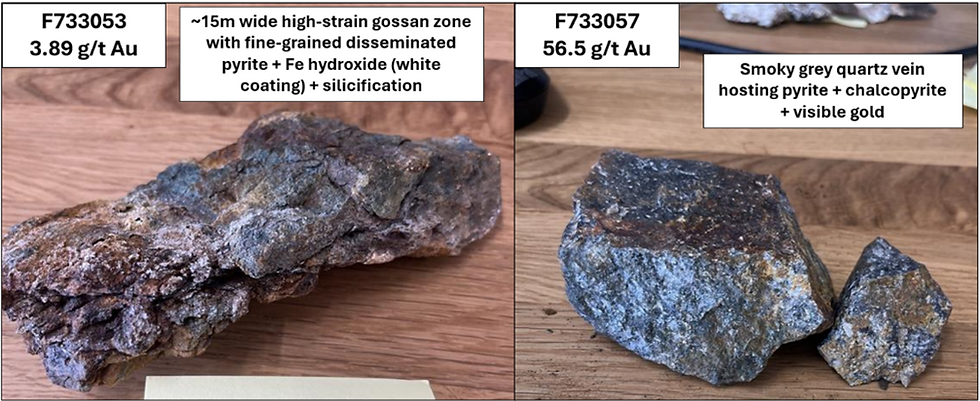

The highest-grade sample returned up to 56.5 g/t Au collected from a smoky quartz vein with blebby pyrite, chalcopyrite, and traces of visible gold (Figure 3).

Grab sample assays from additional prospecting work conducted in October 2024 remain pending. The results are expected to be received by year-end.

The recent reconnaissance prospecting program is expected to guide a property-wide geochemistry survey, scheduled to commence in H1/2025, the results of which are anticipated to provide targets for Athena's initial drill program at Laird Lake.

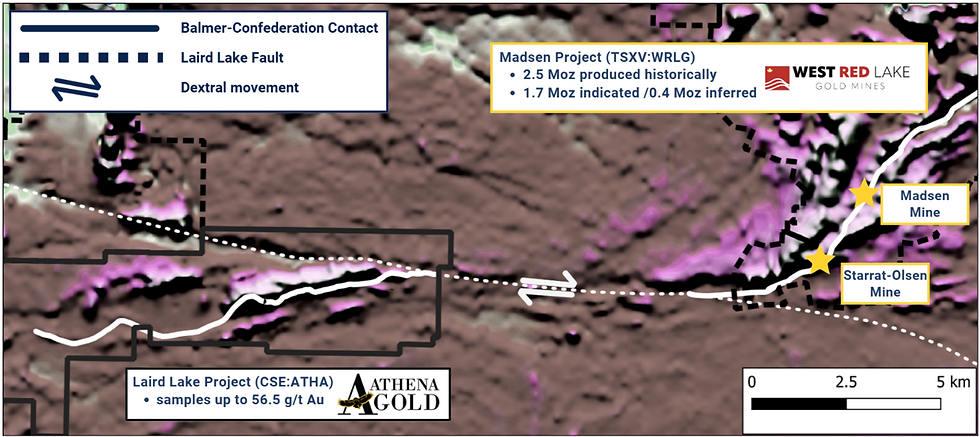

A recently completed MSc. thesis on the Laird Lake project suggested that Laird Lake represents the continuation of the same mineralized structure found at both the Madsen and Starratt-Olsen gold mines now owned by West Red Lake Gold (2.5M oz past-production, 1.7M oz indicated, 0.4M oz inferred) and was later displaced as far as 10 km west (Figure 2).

Figure 1: Laird Lake, showing recent grab samples from July 2024 reconnaissance sampling.

Figure 2: Map of Laird Lake, showing Balmer-Confederation contact and dextral Laird Lake Fault.

Geology:

Gold mineralization observed at Laird Lake occurs in discrete quartz veins hosted in volcanic rock, localized high-strain zones consisting of silicification and disseminated sulfides, and in more broad zones of strongly deformed banded iron formation up to 15 m wide characterized by gossan, fine-grained disseminated sulfides, and silicification. Gold-bearing zones exhibit a general east-west orientation and occur in both Balmer and Confederation Assemblage rocks. The initial grab sample results are described in detail below:

A sample of smoky quartz vein hosted in Balmer Assemblage volcanic rock containing blebby pyrite, chalcopyrite, and visible gold returned 56.5 g/t Au (F733057). This sample was taken approximately 50 m north of the contact with the Confederation Assemblage and was the most western sample collected. Two additional samples of gossaned and silicified volcanic host rock collected adjacent to the high-grade quartz vein returned 1.47 g/t Au and 2.40 g/t Au (F733056 and F733058, respectively).

A sample of strongly deformed banded iron formation (BIF) from the Balmer Assemblage containing fine-grained disseminated pyrite and silicification returned 3.89 g/t Au (F733053). It was collected from an outcrop approximately 15 m in width and characterized by a strong overall deformation fabric with several high-strain zones of gossan, fine-grained pyrite, and silicification throughout. The outcrop is located approximately 60 m north of the Balmer-Confederation contact.

A sample of sulfide-bearing quartz vein hosted in the Confederation Assemblage returned 1.57 g/t Au (F733062). This sample was collected approximately 225 m south of the Balmer-Confederation contact.

A sample of sulfide-bearing quartz vein hosted in a high-strain zone within Confederation Assemblage returned 7.18 g/t Au (F733065). The high-strain zone is characterized by silicification, fine-grained disseminated sulfides, and lesser gossan. Refolded quartz veins were noted along the contact of the high-strain zone and volcanic host rock. This sample was collected approximately 180 m south of the Balmer-Confederation contact eastern-most sample collected.

Figure 3: Photographs of grab samples F733053 (left) and F733057 (right) from July 2024 prospecting at Laird Lake.

Figure 4: Photographs of outcrops for samples F733051-53 (left) and F733057 (right) from July 2024 at Laird Lake.

Future Drill Testing:

Laird Lake has been subject to only very limited historical exploration work, largely because the Balmer-Confederation contact was only mapped on Laird Lake in recent times as part of an MSc. research thesis. Importantly, >90% of all gold ever mined in the Red Lake Gold District is estimated to occur within 300 m of this contact. Athena's initial work programs are focused on understanding structural controls and potential splays off this contact that may host high-grade gold mineralization. Additional assays from the follow-up program that took place in October 2024 remain pending, with results expected by year-end. Athena plans to conduct a property-wide gold-in-till geochemistry program in Spring 2025. Historical, high-resolution airborne magnetic and electromagnetic surveys highlighted several prospective targets within the Balmer Assemblage that have yet to be tested will be included in future drilling on the property, in addition to other targets generated from prospecting and geochemical programs.

About the Laird Lake Project The 4,158-ha Laird Lake property is situated 20 km to the southwest of the town of Red Lake, Ontario. The Red Lake is a prolific gold mining town in Northwestern Ontario that has seen over 30M oz of gold produced. Importantly, >90% of the gold has come from within 300 m of the contact between the Balmer and Confederation Assemblages. The Laird Lake property is considered underexplored for gold, relative to much of the surrounding Red Lake Greenstone Belt, despite possessing over 10 km of strike length of the known gold-bearing contact between Balmer and Confederation Assemblage rocks. Also important is being nearby to several major gold production and exploration sites in the region:

34 km to the Great Bear project (Kinross - 2.7M oz indicated, and 3.9M oz inferred);

11 km to the Madsen Mine (West Red Lake Gold - 1.7M oz indicated, and 0.4 Moz inferred); and

28 km to the Red Lake Mine (Evolution Mining - 7.2M oz indicated, and 4.5 Moz inferred) [iv].

Limited exploration activity at Laird Lake has demonstrated that high-grade gold mineralization occurs in both Balmer and Confederation Assemblage rocks over several kilometres in proximity to the main Balmer-Confederation contact. The highest gold grades on the property show a strong correlation to high-strain zones characterized by the presence of silicification, disseminated sulfides, and gossan. The Laird Lake property is dominated by mafic to ultramafic metavolcanic rocks as well as lesser banded iron formation of the Balmer and Confederation Assemblages. Felsic to ultramafic intrusive units are also present throughout the property, most notably of which include the Killala-Baird Batholith to the north, and the Medicine Stone Lake Batholith to the south.

Fintech

On November 15, 2024, Tenet Fintech Group Inc. (CSE: PKK) (OTCQB: PKKFF) announced that it has closed a non-brokered private placement financing by selling 8,650,000 units to "accredited investors" within the meaning of NI 45-106 - Prospectus Exemptions and under the applicable securities laws, with each unit priced at $0.10 for gross proceeds of $865,000. The Financing is a follow up to the private placement closed by the Company on September 4, 2024, and forms part of a series of capital raises by Tenet to fund the commercialization of its upcoming ie-Pulse product, to help meet certain anticipated strategic partnership obligations and for general working capital purposes. The securities issued in connection with the Financing are subject to a hold period of four months and one day from the closing date of the Financing.

Each unit of the Financing is comprised of one common share of the Company and one Common Share purchase warrant. Each Warrant entitles the holder thereof to purchase one Common Share at an exercise price of $0.20 for a period of 36 months from the date of issuance thereof. After a period of 12 months from the date of their issuance, if at any time the price of the Common Shares closes at or above $0.30 for 10 consecutive trading days, the Expiry Date of the Warrants will be reduced to thirty 30 days. Any Warrants remaining unexercised after the Accelerated Expiry Date will be cancelled.

On November 18, 2024, Tenet Fintech Group Inc. (CSE: PKK) (OTCQB: PKKFF) Vice-president of Marketing, Luc Godard, gave a presentation on growth strategies for SMEs as a subject matter expert at the 2024 edition of the Strategies PME event on November 20th, 2024.

The Strategies PME event (https://www.strategiespme.com/en/) was specifically created over a decade ago to help Quebec-based SME owners and entrepreneurs not only succeed but thrive by bringing them together with experts in various fields. Participants can obtain advice on everything from how to become better managers to the dos and don'ts of business expansion, as well as learn about new products and services to help their businesses grow. The 2024 event was held at Montreal's Convention Centre on November 20th and 21st, where more than 6,000 visitors from a variety of industries were expected to attend.

In addition to the speaking engagement, Tenet had a booth presence during both days of the event, where event participants came by and learned more about how the Cubeler® Business Hub can help them grow their sales and explore new business opportunities.

On November 19, 2024, Tenet Fintech Group Inc. (CSE: PKK) (OTCQB: PKKFF) announced that it has deployed a new version of the Business Hub that includes full versions of the Networking and Advertising modules of the platform following the beta launch of the new modules on October 9, 2024.

Tenet not only made modifications and additions to the Networking and Advertising modules based on feedback and comments garnered during the beta phase but also reinforced certain security aspects and made several enhancements to the platform's Financing module. Registered members of the Business Hub can now receive better-suited pre-qualified credit offers from the platform's commercial credit partners, use their Cubeler Points™ to run advertising campaigns to promote their products and services, and communicate with one another through public posts and private messages, among others.

On November 22, 2024, Tenet Fintech Group Inc. (CSE: PKK) (OTCQB: PKKFF) and Dext Software Ltd., the global leader in bookkeeping automation software, are pleased to announce that they have entered into an agreement to bring Dext's software platform to members and bookkeeping partners of the Cubeler® Business Hub.

"The businesses that both Dext and Tenet serve are eager to leverage technology to drive innovation, efficiency, and growth. The availability of Dext's platform as part of Cubeler®'s Business Hub is a natural fit, enabling firms and businesses to gain real-time control over financial data and business insights," said Rachel Fisch, General Manager, North America, Dext. "We are excited to partner with Tenet to bring Dext's powerful automation tools to the Cubeler community."

Cubeler® Business Hub members and partners can now leverage Dext's unified bookkeeping automation platform, and benefit from recent feature releases, such as Approvals, Supplier Statements and Mileage. Under the terms of the two-year partnership between Tenet and Dext (the "Partnership"), Dext will be included as part of the Cubeler® Business Hub's platform offering to provide even more value to small and medium-sized businesses. Tenet was also granted a seat on Dext's North American Partner Advisory Council, which helps shape the future of Dext's product offering.

Technology

On November 18, 2024 – Visionstate Corp. (TSXV: VIS) had a presence at the ISSA Show North America, from November 19 to 21 at the Mandalay Bay Convention Center in Las Vegas. Attendees visited Visionstate at Booth 559 to explore its WANDA™ platform and learn more about its cutting-edge solutions for the cleaning and facility management industry. Visionstate is demonstrating the full capabilities of WANDA™, its flagship platform that tracks cleaning and maintenance tasks to improve safety and operational efficiency integration with IoT hardware, including people counters, environmental sensors, and supply monitoring devices.

The ISSA Show North America is the premier global cleaning and facility service event, renowned for fostering education, innovation, and collaboration. Visionstate is proud to join industry leaders in showcasing advancements driving the industry forward.

"We're thrilled to be part of the ISSA Show this week," said Shannon Moore, President of Visionstate IoT Inc. "This event is the perfect platform to connect with industry leaders, showcase WANDA™'s transformative capabilities, and demonstrate the IoT hardware that enhances its functionality."

-01.png)

Comments